Content

- Why Choose An Accounting Service in Indiana Rather Than Doing It Yourself?

- tools. 1 place. Save time and money.

- What does bookkeeping entail?

- Other online bookkeeping services we considered

- Money Classic

- How to Choose an Online Bookkeeping Service as a Business-of-One

- What Do You Understand About Virtual Bookkeeping?

When you think of online bookkeeping, you might think of anything from a virtual assistant to software like Xero. Back in the previous days, be it a small business or a larger enterprise, all would opt for a local bookkeeper in their community. The companies would send them their monthly transactions, and the bookkeeper would send them back well arranged and categorized. If you have uncountable data entries to make every day and it’s hard to hold track of all of them alone, you need help; hire a virtual bookkeeper.

If you already work with a CPA and plan to have them continue filing your taxes for you, you don’t need to worry about finding a bookkeeping service that provides tax services. But if you need tax filing and advice along with bookkeeping, you’ll want to look for a company that provides both services. Also, check that the bookkeeping services you’re considering file taxes for companies in your business’s industry. For example, not all services file taxes for nonprofits, so make sure to ask questions and read the fine print before deciding on a company. Pilot’s Core plan is for pre-revenue businesses and is priced based on your company’s monthly expenses. The Core plan starts at $499 per month and includes a $200 first-year discount for pre-revenue startups.

Why Choose An Accounting Service in Indiana Rather Than Doing It Yourself?

The online bookkeeping service is extremely important for the business owner. It helps them keep track of their expenses and incomes and decide on various aspects of their business, such as pricing, inventory, etc. We also provide valuable insights about starting a business and staying on top of the ever-changing tax laws.

They may work closely with the client’s tax advisor or accountant during tax seasons. We provide full-service bookkeeping and accounting solutions customized to meet the needs of your business in a timely, accurate manner. Located in Central Indiana, we provide virtual, outsourced bookkeeping, accounting, payroll, and fractional CFO services throughout the Midwest, and the entire United States. Services like Gusto simplify payroll and taxes for both small and large businesses, from those with just a few contractors to organizations with employees and robust benefits packages. For full tax support, you need to work with an accountant (CPA) or IRS Enrolled Agent (EA). Bookkeepers can keep your financial records in order to make sure you’re prepared for tax time, but they’re not allowed to prepare and file tax returns for you like a CPA or EA is.

tools. 1 place. Save time and money.

They synchronize your financial accounts to the software and automatically record and categorize your data, creating a financial report. You can communicate your financial data via the software you two are using, and he will organize them as per the best of your interest. Maintaining organized and accurate books makes running a small business much more manageable if you hire a bookkeeping service. Lasiter & Lasiter CPAs will keep your books straightforward and up-to-date. You can message the bookkeeping team at Merritt anytime, and you’ll receive a same-day reply. If you’re unhappy with the services for any reason, email Merritt within 90 days of receiving your first set of reports, and you’ll get a full refund.

Can you make a living off bookkeeping?

Average salary

Freelance bookkeepers set their own rates and often charge an hourly rate of $40-60. If a freelance bookkeeper has multiple clients and works full-time, they frequently earn more than the salaried bookkeeper's $35-40,000 per year.

Lasiter & Lasiter CPAs has a team of experienced professionals offering comprehensive tax preparation services for small businesses and individuals. We take the time to understand your unique situation and tailor our accounting services to meet your needs. Our accountant will provide you with accounting and tax services and will work with you to ensure that you get the most out of your tax return and minimize your tax liability. With the Essential plan, you’ll get monthly bookkeeping and a year-end financial package, including your financial statements and 1099 reporting, if needed. With the Premium package, you’ll also get unlimited, year-round tax advisory services, and Bench will file your income taxes for you.

What does bookkeeping entail?

To apply in person, reach out to your local admissions team and arrange a meeting. Or, stop by any campus on any Tuesday for to receive personal assistance with applying and registering for classes. At KRD, we pride ourselves on taking a collaborative approach with our clients, while also being a seamless extension of your current accounting and bookkeeping functions. We start out with an in-depth on-boarding process that defines roles, policies and procedures. You’ll have an open and direct line of contact with your KRD team member, and prompt response to any and all inquiries made.

Our virtual bookkeeping services are designed to meet the unique financial needs of businesses in the dynamic Indiana market. Virtual bookkeeping services provide access to a team of experienced bookkeeping professionals. You benefit from their expertise, knowledge of accounting regulations, and proficiency in bookkeeping practices without the need to hire and train in-house staff. Virtual bookkeepers stay updated with the latest industry trends, ensuring that your financial records are compliant with relevant accounting standards. Their expertise also extends to offering financial insights and recommendations, helping you optimize your financial processes, control costs, and maximize profits.

Our mission is to make online businesses more profitable by providing financial transparency and tax savings. Back bookkeeping services help you get fully caught up with tax-ready financials in less than a week. The virtual bookkeeper communicates with the client to address queries, provide financial insights, and collaborate bookkeeping services in indianapolis on financial matters. They may also coordinate with other team members or the client’s accountant to ensure smooth financial operations. The bookkeeper assists with tax-related tasks, such as preparing financial information for tax filings, generating tax reports, and ensuring compliance with tax regulations.

At eBetterBooks, we automatically link up straight to your financial accounts and access the transactions. Then comes the categorizing part, where we organize them under specific categories, hence presenting them as a lustrous financial report. Basis 365 Accounting Services in Indiana — A top notch bookkeeping company in Indiana that offers exceptional accounting professionals.

Other online bookkeeping services we considered

Pilot uses QuickBooks for all bookkeeping services, and it integrates with popular apps like Stripe, Square, Shopify, Gusto, Expensify, bill.com and more. You can communicate with your bookkeeping team through Pilot’s customer portal. There is a one-time onboarding fee equal to the cost of one month of bookkeeping.

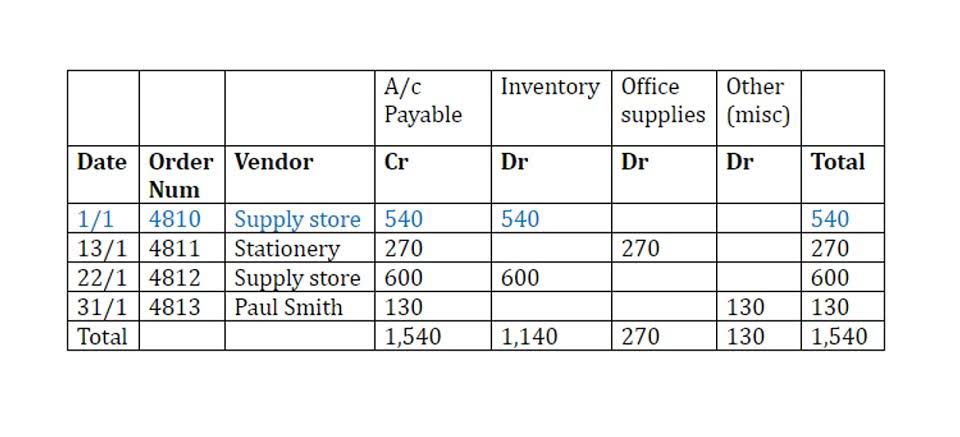

EBetterBooks goes hand in hand with your accountant and ensures they get every information they need and assist you in getting as many tax deductions as feasible. Be it a freelancer or services like eBetterBooks, the method to pick the most suitable one for your business is the same. We protect your data with 256-bit SSL/TLS encryption—the same level of encryption as online banking. The paperwork previewed in the image will provide the structure and language for an Accountant/Bookkeeper to solidify a Client job.

Get instant access to popular businesses, franchises, industry advice and special offers. Once you have completed the steps above, you may register for classes. Ivy Tech students register for courses using the Schedule Builder tool which can be accessed within MyIvy.

- Would you like to speak to one of our financial advisors over the phone?

- But nowadays, even most of the local bookkeepers are shifting towards digitalization.

- You should engage a qualified tax professional or accountant to evaluate your business and help determine applicable tax and legal obligations.

- This includes keeping track of financial transactions, categorising spending, reconciling accounts, and producing financial reports.